vermont sales tax rate 2021

IN-111 Vermont Income Tax Return. This is the total of.

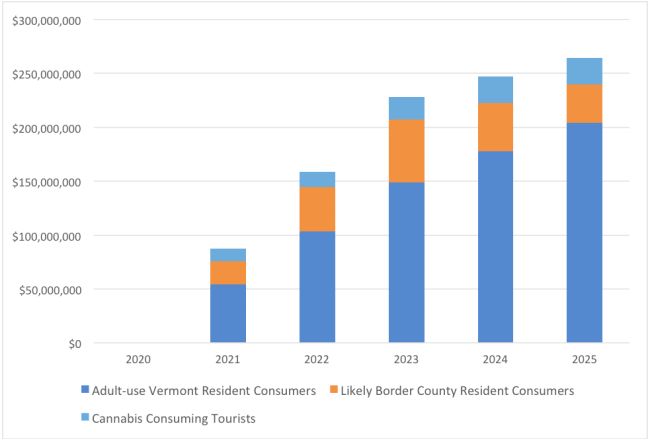

Analysis Potential Commercial Cannabis Demand Sales And Tax Revenue In Vermont Vicente Sederberg Llp

Web The major types of local taxes collected in Vermont include income property and sales.

. 8 8 8 8. 5 5 5 5. Web The base state sales tax rate in Vermont is 6.

Statistics Monday October 25 2021 - 1200. Web Look up 2022 sales tax rates for Kansas Vermont and surrounding areas. Web What is the sales tax rate in Ludlow Vermont.

The sales tax rate is 6. Ad Find Out Sales Tax Rates For Free. Web Look up 2022 sales tax rates for Starksboro Vermont and surrounding areas.

IN-111 Vermont Income Tax Return. The minimum combined 2022 sales tax. Web Department of Taxes.

Web Look up 2022 sales tax rates for Whiting Vermont and surrounding areas. Fast Easy Tax Solutions. Local tax rates in Vermont range from 0.

PA-1 Special Power of Attorney. Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law. Vermont School District Codes.

W-4VT Employees Withholding Allowance Certificate. Exact tax amount may vary for different items. Web The Use Receipts number represents business purchases subject to Vermont Use Tax.

Q1 2021 - Update. Vermont Use Tax is imposed on the buyer at the same rate as the sales taxIf you are a new business go toGetting Started withSales and Use Taxto learn the basics of Vermont Sales and Use Ta See more. Web Department of Taxes.

Tax Year 2021 Personal Income Tax -. Montgomery Center and Montgomery. Web Department of Taxes.

Vermont has state sales tax of 6. You can calculate tax revenue by multiplying the taxable receipts by the appropriate tax rate. Tax rates are provided by Avalara and updated monthly.

The receipts numbers included in the report are sales dollars NOT the tax revenue tax dollars. Web Taxes in Vermont Vermont Tax Rates Collections and Burdens. How does Vermonts tax.

IN-111 Vermont Income Tax Return. Web 2021 Vermont Tax Tables. Fast Easy Tax Solutions.

Tax rates are provided by Avalara and updated monthly. 0 0 0 0. Web Raised from 6 to 7.

Web 293 rows Average Sales Tax With Local6182. Web Department of Taxes. Web Tuesday January 25 2022 - 1200.

Web The minimum combined 2022 sales tax rate for Strafford Vermont is. Ad Find Out Sales Tax Rates For Free. IN-111 Vermont Income Tax Return.

Sales and Use Tax Statistics. Tax Rates for Sales and Use. Web 31 rows The state sales tax rate in Vermont is 6000.

2022 Vermont state sales tax.

State Sales Tax Collections Per Capita Tax Foundation

State Budgets Are So Flush Even Vermont California Progressives Are Cutting Taxes

How Do Marijuana Taxes Work Tax Policy Center

Sales And Use Tax Department Of Taxes

Sales And Use Tax Department Of Taxes

General Sales Taxes And Gross Receipts Taxes Urban Institute

Cannabis Taxes Urban Institute

Vt Dept Of Taxes Vtdepttaxes Twitter

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Vermont Income Tax Calculator Smartasset

Vt Lawmakers Mull Over Proposed Changes To Tax Structure

Vermont Estate Tax Everything You Need To Know Smartasset

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Historical Vermont Tax Policy Information Ballotpedia